If you have ever been on a business trip or made a company purchase, you probably know how tedious it can be having to keep and present stacks of paper receipts afterwards. Enters Kwick – receipt handling done electronically (and easily)

Problem vs solution

Like many great business ideas, the concept of Kwick started with frustration over a problem without solution – or an unmet need in the market, if you may. At the time, Johan Magne, co-founder and COO at Kwick, was working as a consultancy manager for a company where he had to handle a vast number of paper receipts in his day-to-day work.

“It was so much time-consuming manual work involved keeping track all paper receipts for company purchases. Not to mention how dreary it was having to sit and go through a bunch of receipts on a Friday afternoon. It was hard to grasp how the system could be so outdated in our increasingly digitalised world,” says Johan Magne.

Johan shared his frustrations with his friends and co-founders Marc McKenzie (current CTO at Kwick) and Rickard Holmén (CEO). Together, they came up with an electronical solution to the problem of receipt handling and founded Kwick in 2011.

Taking off

After several years of working on developing their platform and business model, the entrepreneurs finally had a finished product which they could scale up.

“We brought something new to the market. We work closely with banks and we did a pilot project with Nordea to build a lasting relationship and ensure everything was running smoothly. We needed more than just a vision; we needed hard proof that it worked too,” says Johan.

And it did work. Johan and his colleagues hired more sales people and developers to find more partners and extend their business. Today, they are about ten people working at Kwick.

“We sell our services to larger enterprises and approach the companies that are important for our clients, like taxi companies, parking providers, rail services and airlines.”

All about the money

Kwick can boast of having some major players among their clients, i.e. JM, Nordea and Vattenfall. About 100 companies use the service today. Recent statistics from Nordea show that companies can make a real saving using Kwick.

With around 20,000 employees across the Nordic countries using Kwick, Nordea saves at least 20 million SEK (1,9M EUR) per year by using the service.

Kwick comes at a low price; 95 SEK (9 EUR) per user and month.

“It is like having an additional service to the company credit cards.”

It was hard to grasp how the [receipt handling] system could be so outdated in our increasingly digitalised world.-Johan Magne, Co-founder and COO at Kwick

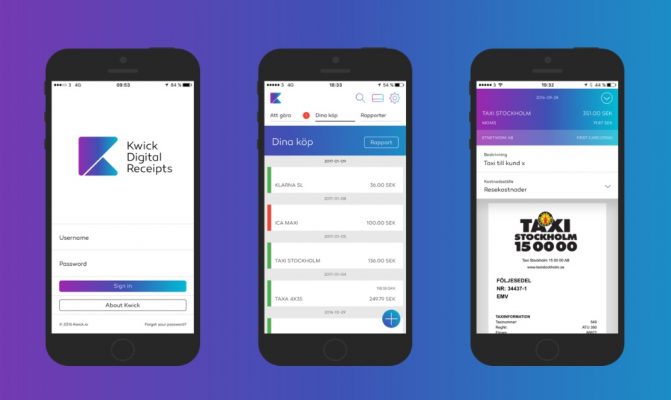

How it works

Kwick works with a patented technology that automatically connects a transaction, e.g. a taxi journey, to a payment transaction without any manual interference. Previous solutions on the market meant emailing receipts, membership requirements or handling of physical receipts.

“When using Kwick, you don’t have to do anything. You pay your taxi journey with your credit card, which is connected to Kwick, and neither the employee nor the taxi driver need to bother with paper receipts. The receipts automatically end up in the company bookkeeping system as a note to the transaction in question, explains Johan.

“It is a real smooth process.”

Win-win for all

Statistics have also shown that companies connected to the Kwick service dramatically increase their profit as other Kwick users are more prone to choose companies using the same system. One taxi company using Kwick has for example seen an increase of between 6 to 10 million SEK (578K EUR – 964K EUR) per year from increased sales.

For receipts that cannot be delivered via the automatic system, Kwick offers an app which displays purchases and receipts. Although you need to hang on to your paper receipt, the photo will be uploaded to the bookkeeping system so your supervisor quickly can approve the purchase.

Projects involving club cards and cards for personal use are in the pipeline for Kwick. Within the next few months, Kwick will be offered as a free service to millions of personal bank card holders in the Nordic countries.

“It is useful when you need a receipt to bring something back to store that you’ve bought. That way you don’t need to save your paper receipt and risk losing it.”

Intellectual Property

Kwick transferred their IP portfolio to AWA after previously working with another leading IP firm in Stockholm. They now work closely with Partner and European Patent Attorney Anders Fredriksson at AWA’s Malmö office.

“Anders is brilliant. He takes responsibility and shows a genuine interest in us and our company. I think that is what was missing with the IP firm we used before; they didn’t care how our patent registration was going – all they did was send us bills. As a client, you want commitment and dedication from your IP attorney.

“We are very happy we decided to give AWA a go. In fact, we’ve never looked back.”

In addition to the recently patented technology for connecting transactions, which is to be issued in November, Kwick has invested in their IP by successfully registering the trademark ‘Kwick’ in the EU. They have another on-going patent process relating to how the receipts are distributed to the connected companies.

“IP is crucial to us for getting partners onboard. It is a seal of approval that we know what we are doing and nobody can copy our technology.”

Kwick

For more information on Kwick, please visit their website.

For their IP matters, Kwick is consulted by Anders Fredriksson (patents) and Anders Trulsson (trademarks) at AWA’s Malmö and Lund offices.